This month we’re watching for recession indicators, falling rates, and a rollercoaster ride for home market values.

We are headed for a Recession. But don’t worry, this is great news. The 2023 Recession will lower interest rates and increase your home’s market value.

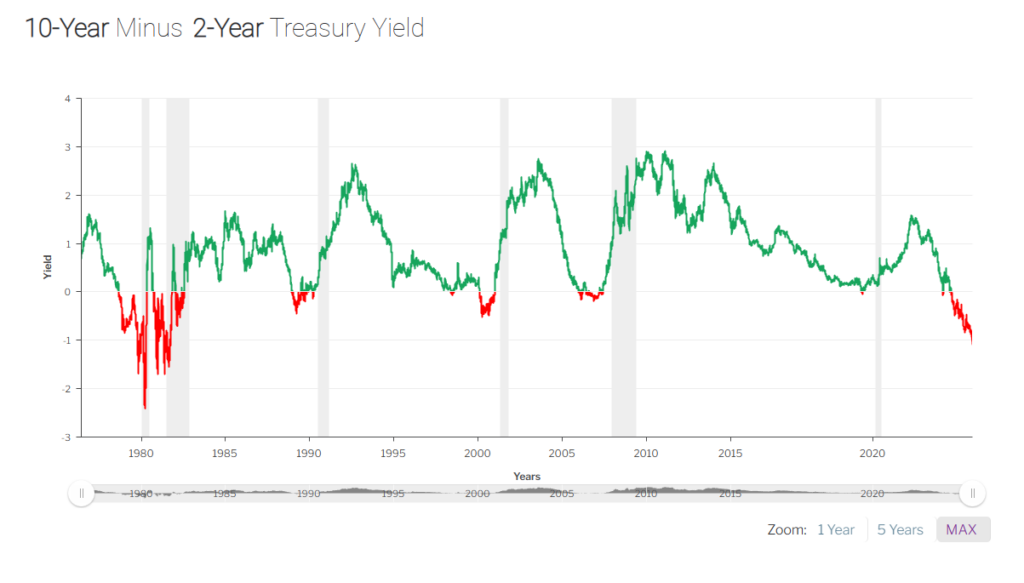

10 Year vs. 2 Year Treasury INVERSION

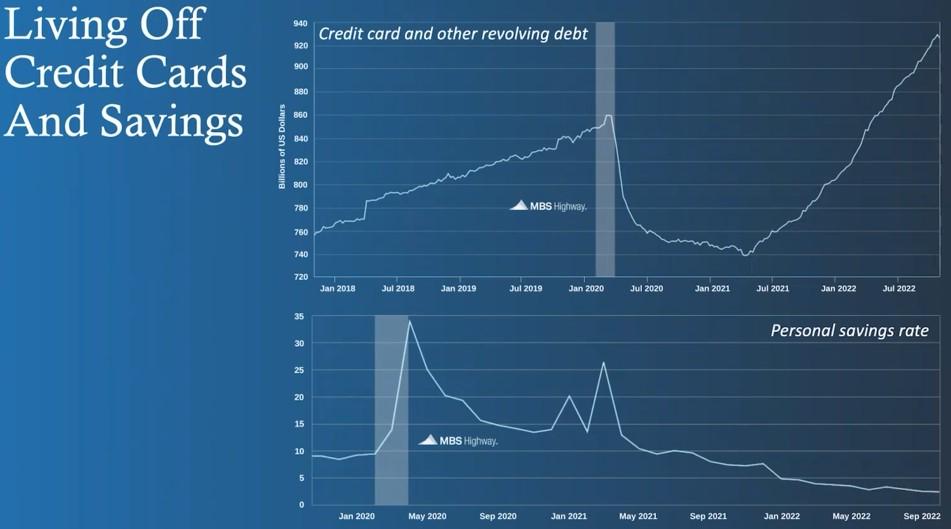

Credit Card Debt and Personal Savings

The trickster in the economy right now is personal spending. People are still spending a lot of money which is supporting an economy that otherwise might be in trouble by now. But a closer look shows that to do this people are using Credit Card Debt and dipping into their personal savings. This is fine in the short run but it’s not a trend that can continue forever.

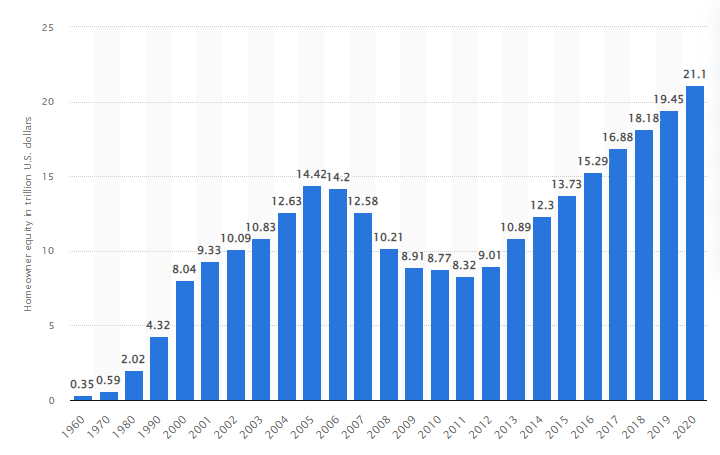

Average Home Equity

Americans are enjoying record levels of home equity. Some Analysts claim the average home equity position in America right now is around 58%.

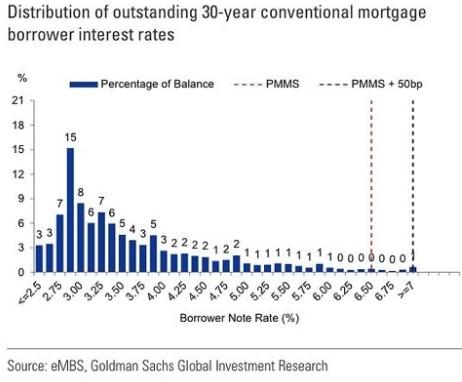

Average 30 yr Fixed Interest Rate

Not only do people have lots of equity in their homes they also have incredibly low interest rates.

Of all 30 yr fixed mortgages in America:

- 28% have interest rates under 3%.

- 75% have an interest rate at 4% or lower.

Foreclosure Rates

High equity and low interest rates are protecting our economy from foreclosures. We are at record low foreclosure rates. Home values are stable because of these factors. If people need to sell a home they may drop the price 5% maybe even 10% but most people would never cut their price 40%-50% in order to sell a home they can afford the payment on.

Interest Rates

This graph shows the mortgage bond market. It indicates that we have turned the corner on interest rates. Inflation is falling and as inflation falls interest rates will fall with it.

I expect interest rates will be in the low 5% range by July 2023.

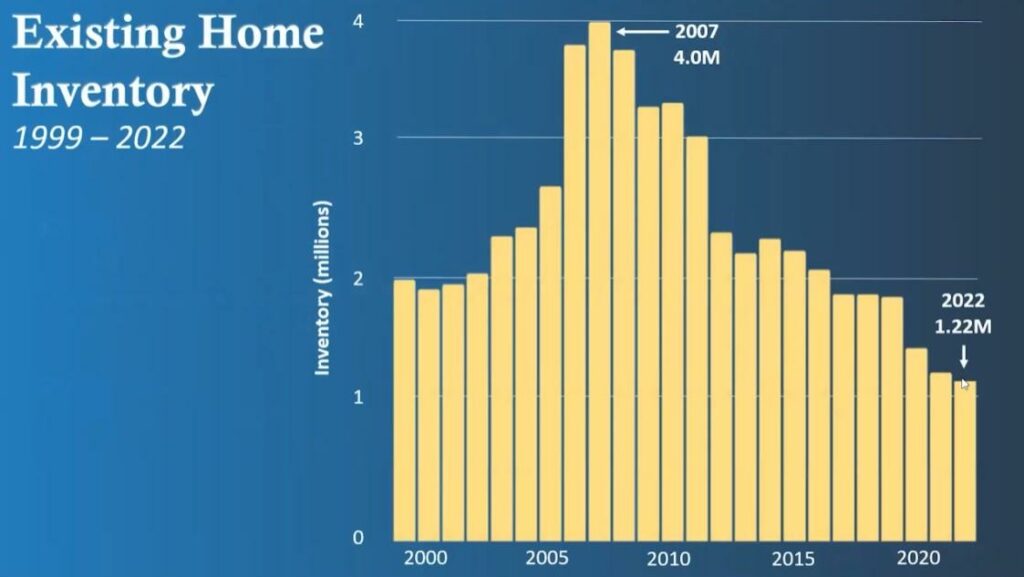

Pent up Demand

Demand for housing is higher than it’s ever been and inventory is at record lows. The Real Estate Market right now is a little slow because of the low affordability of high interest rates. BUT when interest rates fall, home buyers will Flood back into the market pushing home values back up.

WHAT YOU NEED TO DO NEXT:

Act now if you are going to buy or build.

Now is an excellent time to buy or build a home. Values may be softening for the first part of 2023. But by the end of this year the number of buyers coming back to market will push values back up. The Market is likely offering you the best prices of the year right now.

Refinance:

If you already own your home then we need to be ready to refinance your mortgage around May or June to reduce your rate, take cash out or improve the loan in any way possible.

If you or someone you love needs information on a mortgage please let me know.

Trevor Carlson

President – Equity Conversion Specialist

Heritage Reverse Mort.

435-359-9000

Heritage NMLS #1497455 Trevor’s NMLS #: 267962

1060 South Main Street Bldg. A Suite 101B

St George Utah 84770