What happens to Interest Rates during a Recession?

A lot of people don’t understand what happens to interest rates during a Recession. Fortunately, we have decades of Historical data to learn from so we can predict what the future brings.

This year, 2022 has been the year of high inflation and high interest rates. Next year, 2023 will bring with it a global Recession and low interest rates. Here is the evidence I have to prove it.

Interest Rates:

Interest Rates are an indicator of economic strength.

- High interest rates equal a strong economy.

- Low interest Rates equal a weak economy.

The low interest rates of 2020 and 2021 were a direct result of the bad covid economy. The high interest rates of 2022 are the direct result of a raging economy and high inflation.

Inflation:

Inflation is driven by The Federal Reserve and their monetary policies when it comes to manipulating the fed Funds Rate.

Inflation & Interest Rates:

Act like a dog and it’s tail. Where inflation goes, interest rates will ALWAYS follow. If inflation goes up, interest rates will too. When we enter a Recession and inflation comes down so will interest rates.

What does History tell us:

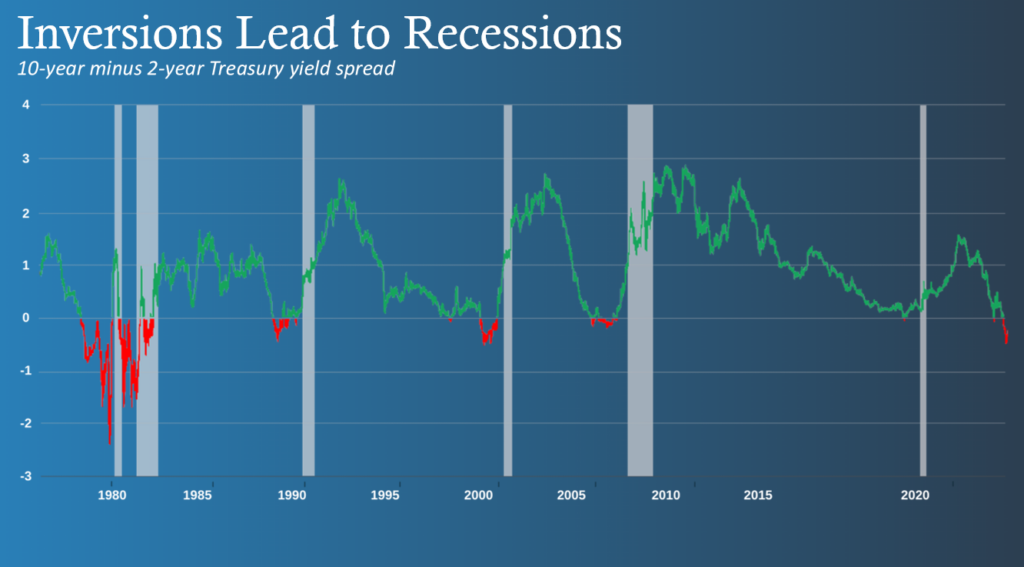

There are multiple factors that indicate we’re headed for a Recession. My favorite is the relationship between the 2yr US Treasury bond and the 10 year Treasury bond.

In a Normal market the Treasury bond acts a lot like a CD you get from a bank. In that when you invest longer, you should get a higher return. But when the economy gets wonky, the yields of the 2yr treasury and the 10 yr treasury get inverted. This means that if you invested in a 2 year treasury today you would make a higher return then you would by investing in a 10 year treasury.

Inverted Treasury:

Historically an inverted Treasury yield has predicted with 100% accuracy every Recession we’ve had since the 1970s. Right now the yield is more inverted than it’s been since the 1980’s.

But What about unemployment?:

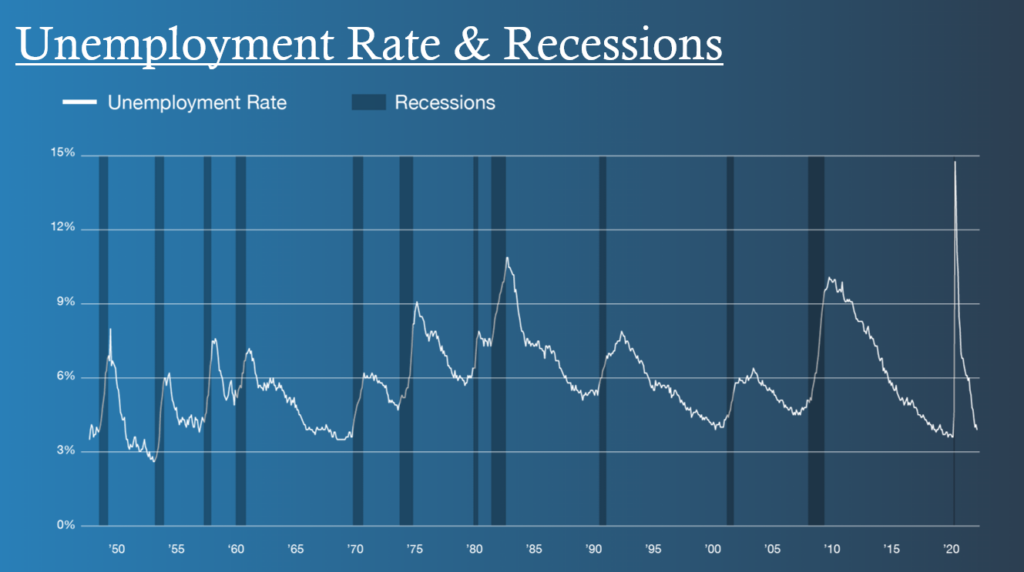

If you watch the news the Federal Reserve and politicians keep claiming we can’t be in a recession because unemployment is at it’s lowest point in years.

What they don’t recognize is that this is also an indicator of future recession. Unemployment ALWAYS reaches the bottom of the cycle immediately before entering a Recessionary period.

What will interest rates do in the Recession:

Fortunately, once again we have history to tell us what will happen next with interest rates. When we hit the 2022/2023 Recession it will impact the global economy like no other recession before. This will stall inflation and bring it back down. And like a tail chasing the dog, interest rates will fall as well.

Hold tight things get better:

It’s understandable if you’re involved in real estate in any way. It’s been a rough year for home owners and professionals. We haven’t seen the worst of it yet, but help is on the way. Watch for inflation to peak, which it will do later this year or early next year. After inflation peaks it will fall and will bring interest rates back down with it which should strengthen our economy.

If you or anyone you care about has questions about Mortgages or Reverse Mortgages please let us know. We specialize in this life changing product and we would love to help you too.

Trevor Carlson

President – Reverse Mortgage Specialist

Heritage Reverse Mortgage

435-359-9000

www.heritagereversemortgage.com

Heritage NMLS #1497455 Trevor’s NMLS #: 267962

1060 South Main Street Bldg. A Suite 101B

St George Utah 84770

A special thank you to Barry Habib of MBS Highway (www.MBShighway.com) and FRED Economic Data (www.fred.stlouisfed.org) for providing the slides of this article/Video along with his expert analysis.