Can a Reverse Mortgage use up all of your equity?

Are you concerned that a Reverse Mortgage will take all your equity? Don’t be, most of my clients have this misconception because they haven’t yet learned about the new Reverse Mortgage, also known as the Home Equity Conversion Mortgage.

The old Reverse Mortgage was not great.

Yes the old Reverse Mortgage had some major flaws and is the cause for most of the myths you’ve heard about the product but fortunately the new Reverse mortgage is designed to protect the homeowner and their equity.

How is the New Reverse Mortgage Better?

The great changes of the new reverse mortgage are:

- They have higher equity reserves and lower loan amounts which protects the home’s equity long term.

- They have lower interest rates and mortgage insurance rates

- They offer protections for both spouses even if one spouse isn’t yet 62 years old or older.

Bottom line, the new Reverse Mortgage protects the home’s equity and the homeowners.

Long-term Results of a Home Equity Conversion Mortgage.

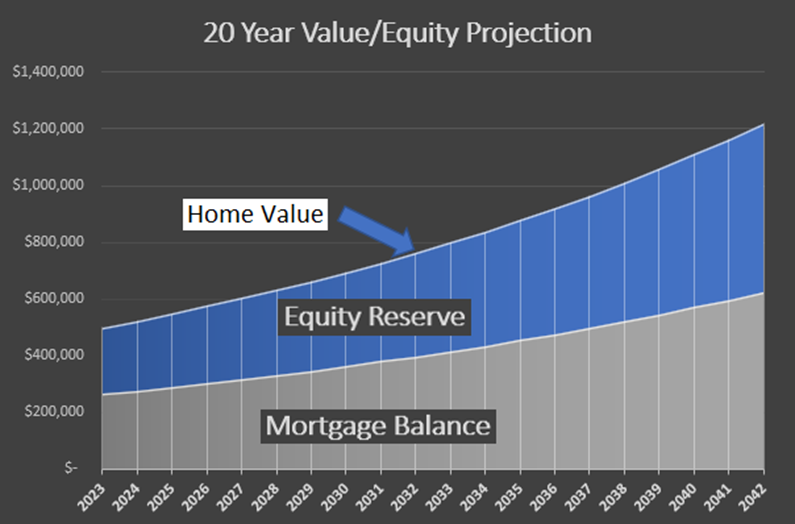

So what does a Reverse Mortgage look like long-term? Below is an illustration of the long-term effects of a HECM on the homeowner’s equity and other assets.

Basic Scenario

- Mr. & Mrs. Smith: Age 72

- Home Value – $500,000 — Mortgage balance – $200,000 – Mortgage Payment – $1,200

- Consumer debt (Cars & Credit cards) of $35,000 with a monthly payment of $1,800.

- Future Projections based on past results.

- Home appreciation over the next 20 years = 4.8% (Based on the national average over the past 50 yrs.)

- Combined HECM and MI Interest Rates = 5% (based on recent historical averages)

Home Equity Analysis – After setting up a HECM this couple eliminated their monthly mortgage payment and consolidated their debts. They saved $3,000 a month in debt payments and their home appreciation grows faster than their mortgage balance. The end result is they continue to increase their wealth and equity in the home even without making monthly mortgage payments.

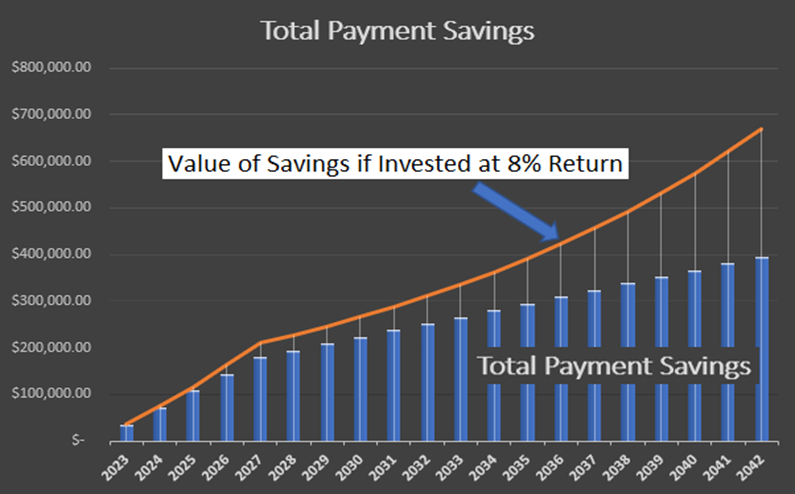

Payment Savings Analysis – Over a 20 year period these homeowners save nearly $400,000 in monthly debt payments. If that money were invested at an 8% return the value after 20 years is nearly $700,000.

By supplementing the powerful benefits of a Reverse Mortgage this couple has dramatically improved their financial plan. They extend their income and retirement assets and don’t have to worry about outliving their financial reserves. This is why Financial Planners love recommending Reverse Mortgages to the clients they really want to help.

*This is not an offer to lend under specific terms. Scenario represents general projections of a possible loan scenario and does not guarantee past or future performance of the HECM product. See lender for specific details regarding your situation including costs and interest rate options.

Trevor Carlson

President – Reverse Mortgage Specialist

Heritage Reverse Mortgage

435-359-9000

www.heritagereversemortgage.com

Heritage NMLS #1497455 Trevor’s NMLS #: 267962

1060 South Main Street Bldg. A Suite 101B

St George Utah 84770