Home Value Report

High interest rates brought the Real Estate industry to a standstill over the past six months. And people have worried that we’re going into another 2008 crash. Fortunately, that does not seem to be the case. Demand for housing is at an all-time high so people still want to buy homes they just can’t afford them.

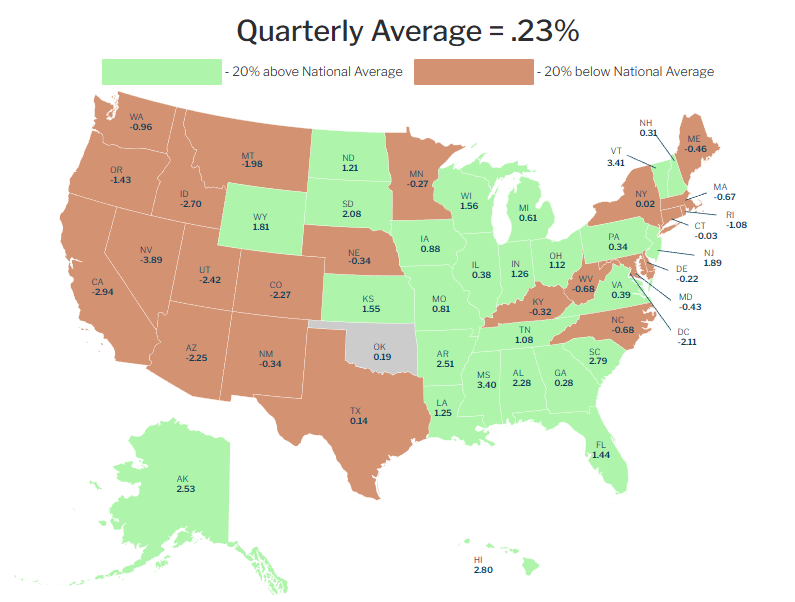

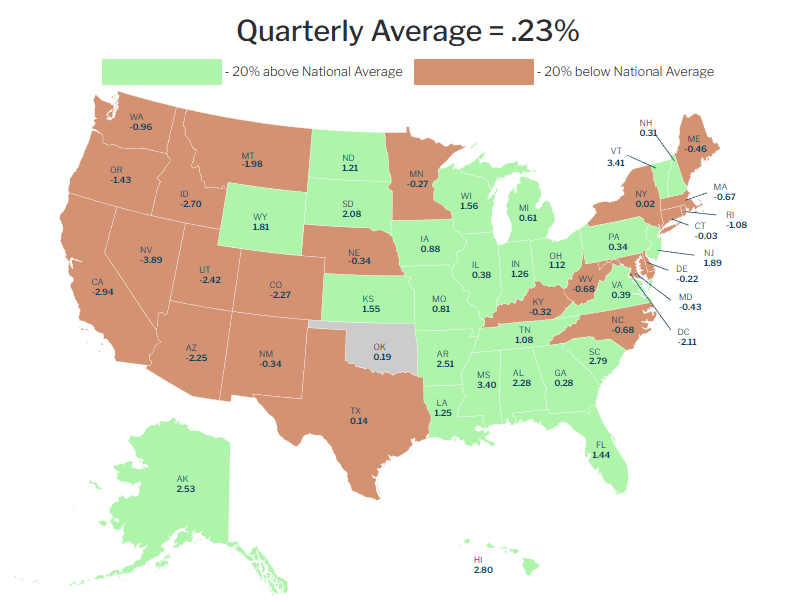

As a result of demand, values are holding firm and patiently waiting for interest rates to come back down. This map shows appreciation/depreciation rates over the past quarter. Most states are currently at a flat or slightly under 0 depreciation rate. In perspective, this is actually closer to normal than what we’ve seen in the past five years but we’ve all become accustomed to double-digit appreciation so in the short term it feels scary but in the long-term, this is actually a very healthy market adjustment.

Interest Rate Forecast

Interest Rates follow inflation like the tail follows the tail. When inflation goes up, interest rates also always go up. This triggers an economic slowdown and sometimes even a Recession which always brings inflation back down and Interest rates always follow closely behind.

Inflation peaked in the United States in November. Consequently, Interest Rates on Mortgages also peaked in November and have been dropping gradually ever since.

Looking forward we expect key inflation data to be released in March and May of 2023 which will bring inflation even lower and could trigger much better interest rates.

Plan of Action

Get Ready – You’ve likely held off on refinancing over the past year because Interest rates have been higher than we’ve seen in over 20 years. Fortunately for you by April of 2023 we should see very good rates coming back and it may be time again for you to talk with us about refinancing your mortgage to save you on interest rate charges and to extend your available funds.

Watchlist

If you have not already been contacted by our team within the past three months please reach out to me so we can make sure you are on our watchlist to be notified when interest rates fall again.

You can email me directly at trevor@heritagehl.com or my team at info@heritagehl.com

Likewise we always love to hear your voice so please give me a call at 435-359-9000.

Trevor Carlson

President – Reverse Mortgage Specialist

Heritage Reverse Mortgage

435-359-9000

www.heritagereversemortgage.com

Heritage NMLS #1497455 Trevor’s NMLS #: 267962

1060 South Main Street Bldg. A Suite 101B

St George Utah 84770