The reasons why the Housing Market WILL NOT crash in 2023.

The Real Estate Market today is fundamentally different from the market in 2008. These are the key differences that exist and why there will not be a housing crash in 2023.

2008 Supply and Demand:

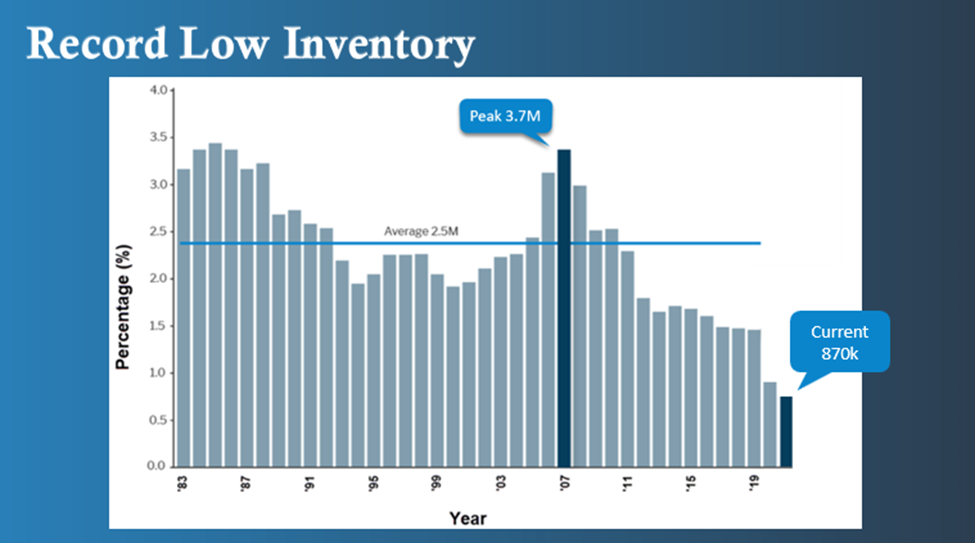

In 2008 Supply was at record levels. Over the past 40 years the average number of homes for sale on the market nationally was 2.5 million. In 2007 inventory hit a record high of 3.7 million homes.

To make things worse builders were continuing to add far more homes to the market than new household growth was asking for. This created a massive glut of available new homes which stalled rising home prices.

In the graph below the orange bares represent new homes built each year. the blue bars represent new households formed, or in other words, new families created that needed their own home.

2023 Supply and Demand:

Going back to those same charts you see that the Real Estate Market in 2023 is the exact opposite of what it was in 2008.

- We are at record low inventory levels over the past 40 years.

- We’ve had far more new households created over the past 10 years than we’ve had new homes for those families to live in.

Senator Mike Lee stated at the 2022 UAMP conference in September that “America is currently around 20 million housing units short of filling current demand in this country.” Add to that, the fact that roughly 4 million people reach adulthood every year in this country and will need a new place of their own to live in.

Demand is the key difference between 2008 and 2023. The difference being that demand is substantially higher than supply.

Foreclosures in 2008 vs. 2023:

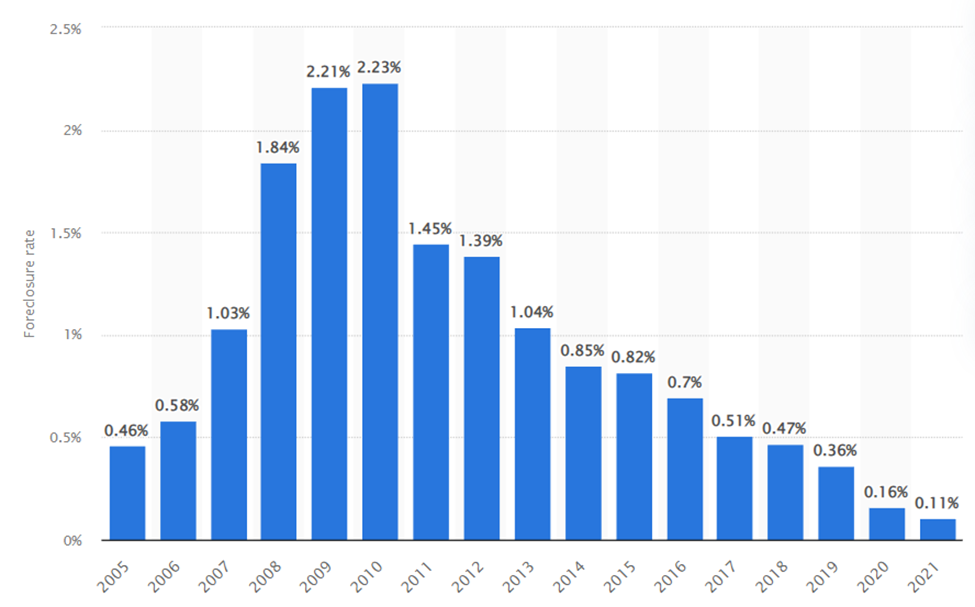

Over Supply and weak Demand started the issues of the 2008 crash. But the gas on the fire was Foreclosures. For years leading up to the crash speculating home buyers used risky loans to do low/no down payment mortgages and adjustable interest rates to buy multiple properties. When values softened and rates went up these homes went upside down and there was no incentive to keep these homes and foreclosure rates shot through the roof.

The banks threw dynamite on the fire when they started slashing prices because of the glut of foreclosures on the market. This is why values crashed in 2008, it was a perfect domino effect where each bad decision led to an even worse decision.

In 2023 we have record low foreclosure rates. Why? Because people have super low fixed interest rates and tons of equity. Forecloses are picking up but will not return to those high levels because people are much less likely to foreclose on a home that has a 3.5% interest rate and 30%+ equity. Yes sellers may cut their prices by 5%-10% to sell a home but they won’t foreclose on a home with plenty of equity. Likewise, the odds a housing crash being caused by millions of people slashing their prices 30-40% to sell a home is crazy unlikely.

Ask yourself this, knowing what you do about human nature and government policies, do you think it is more likely that homeowners will take a 30-40% haircut to leave a home they can afford? Or will the Government/Fed do what they’ve been doing for the past 20+ years and drop interest rates?

2024 Election Cycle and the Predictable future:

One of my key indicators that we will not go into a housing crash in 2023 is the 2024 election. A global recession in 2023 is a foregone conclusion. We are in a recession and it’s effecting the entire world. If the current Fed and leading party in Washington were to keep rates high and force a housing crash in 2023 they are all but guaranteeing the demise of the Democratic party in the 2024 election.

Policy makers love to stay in power and they have created a predictable pattern of what they’ll do when the economy gets weak. That predictable pattern is stimulus and cheap money.

The End Result

As we get deeper into the 2023 recession the government will stimulate by spending, the FED will stimulate by lowering interest rates and buying mortgage backed securities, just like they’ve done in every market hiccup over the last two decades (or last 10 decades if you want to really go down the rabbit hole).

Interest rates in the first half of 2023 will drop significantly from 7% to between 4-5%. Demand for housing will come back to life and home prices will stabilize and even start to rise again. But hopefully not like 2021.

One last cautionary tale that could happen if the Global Recession really has teeth. If world economies start to flatline then world governments could get really aggressive and interest rates could potentially hit all-time lows. I see a possibility that long term mortgage rates could hit all-time lows in the 2% range which would create a ton of demand in the housing market (and inflation).

I hope you find this information helpful.

If you or someone you love needs financial advice on a mortgage or Reverse Mortgage please let us help.

Part 3 of Why the Housing Market WILL NOT Crash in 2023.

President – Reverse Mortgage Specialist

Heritage Reverse Mortgage

435-359-9000

www.heritagereversemortgage.com

Heritage NMLS #1497455 Trevor’s NMLS #: 267962

1060 South Main Street Bldg. A Suite 101B

St George Utah 84770