For the past couple of weeks, I’ve been watching the Mauldin Economics 2023 Strategic Investors

Conference (www.mauldineconomics.com). It is a series of presentations given by the nation’s top

economists, professors and business leaders. Almost without exception every presentation highlighted

the data indicating that we are on the threshold of the 2023 Recession. In fact, it was said multiple times

that this is the most anticipated recession of all time. It seems there isn’t an economist in the country

that will be caught off guard by what’s coming.

The big question is, Are you ready for a Recession and how will it affect you?

Consumer Debt and personal savings

People became accustomed to the free cash handed out during covid stimulus. Unfortunately they have

had a hard time going back to pre-pandemic spending habits especially in light of the super high inflation

we’ve been facing. The result is that personal spending levels are falling and consumer debt levels for

things like Credit Cards are hitting record highs. Below are some charts provided courtesy of MBS

Highway (www.mbshighway.com)

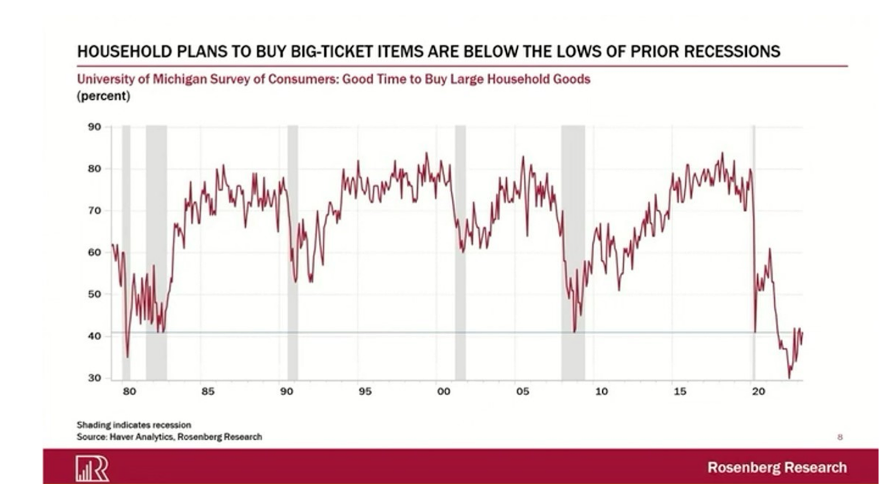

Plans for big purchases

Consumer plans to purchase big ticket items has fallen lower than it’s been since before the 1980’s.

People just don’t have much confidence looking forward that they’ll be able to afford a new house, car,

vacation or any number of luxuries they’ve been enjoying the past few years.

These are key indicators that our economy is headed for a substantial slow down and Recession.

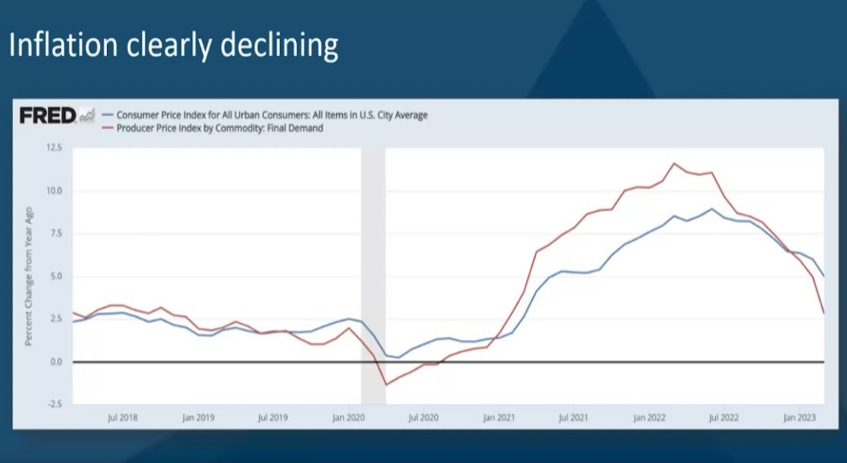

Inflation is Falling

One of the key elements of a Recession is how it affects Inflation. Recessions mean a slower economy

because more people are buying less stuff which means prices tend to come down or at least go up at a

slower pace.

The Consumer and Producer price indexes were released this week which show that for April both

continue to show a dramatic deceleration in the rate of inflation affecting our country. Which is great

news for us as the consumer.

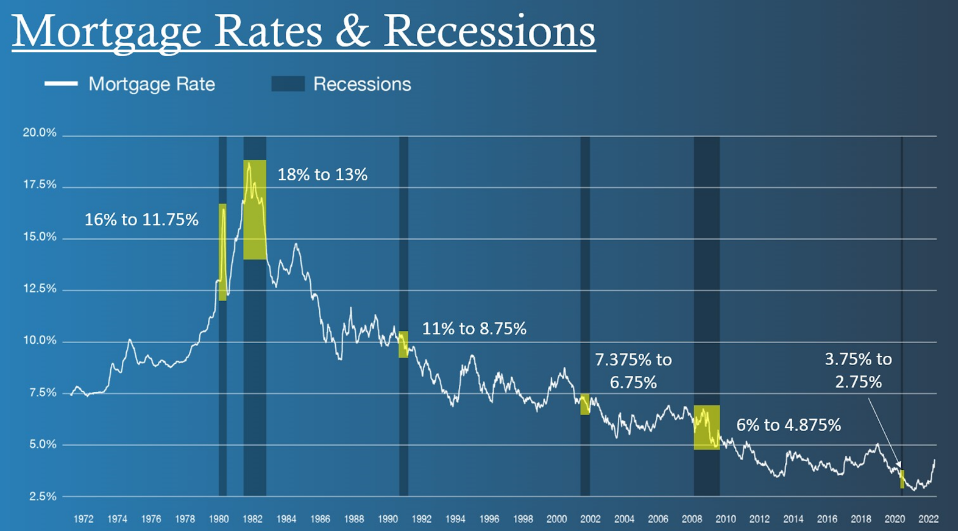

Interest Rates are Falling

When inflation falls, long term interest rates on things like mortgages and car loans also almost always

fall and we’re already starting to see that as well. Interest rates on mortgages peaked in November and

have steadily been declining ever since. We anticipate that rates could be on a downward trajectory for

the next 1-3 years.

What about Home Values?

After 2008 most people worry about their home’s equity when there are talks of a Recession. But don’t

fret. This recession will be different. Demand for housing is at record highs. When interest rates fall,

people will start buying homes again and home values will actually start going up. This exact scenario

has played out 8 of the last 9 recessions and we’re confident it will happen during the 2023 recession as

well.

Call us if you have questions

If you have questions about your home, your mortgage or potentially refinancing please give us a call.

We’re here to help you navigate the market as it shifts during these turbulent times.

Trevor Carlson

President – Equity Conversion Specialist

Heritage Reverse Mort.

435-359-9000

trevor@heritagehl.com

Heritage NMLS #1497455 Trevor’s NMLS #: 267962

1060 South Main Street Bldg. A Suite 101B

St George Utah 84770